Lynex: Revolutionizing DeFi Liquidity on Linea with Concentrated Solutions and ZK Innovation

In the dynamic world of decentralized finance (DeFi), Lynex stands out as a pioneering decentralized exchange (DEX) and liquidity marketplace on the Linea blockchain. As a leading platform in the LST-centric liquidity marketplace, Lynex introduces advanced liquidity solutions, including one of the first ZK Dark Pools in the zero-knowledge (ZK) domain. With a $5.45M Total Value Locked (TVL), $32,733.60 daily trading volume (up 6.5% in 24 hours, 45,415 holders, and over 2.2M transfers, Lynex is driving Linea’s DeFi revolution. Its vibrant community—85k Twitter followers, 29,113 Discord members, and 872 youtube subscribers members—fuels its growth. As Linea’s thriving ecosystem expands, Lynex is poised to capture attention with its ve(3,3) model, Automated Liquidity Management (ALM), and zkLynex privacy features. This guide explores Lynex’s mechanics, standout features, and why it’s a cornerstone of Linea’s DeFi landscape.

What is Linea?

The Linea blockchain, launched by Consensys in 2023, is a high-performance Layer-2 network built on Ethereum, leveraging zero-knowledge (ZK) proofs for sub-second finality, low fees, and Ethereum-level security. With over 100 protocols, seamless MetaMask integration, and developer support via the LEIA funding program, Linea’s ecosystem thrives with DeFi, NFT, and gaming projects. The proto-danksharding EIP enhances its scalability, making Linea a hub for traders, liquidity providers, and innovators. As Linea’s native liquidity layer, Lynex capitalizes on this vibrant ecosystem to drive DeFi innovation.

Lynex: Linea’s Liquidity Powerhouse

Lynex is an advanced DEX and liquidity marketplace on Linea, enabling seamless token swapping, liquidity provision, and governance through its veLYNX voting mechanism. Inspired by Solidly and a friendly fork of Thena, Lynex builds on the successes of Velodrome and Thena, offering a community-driven platform with a $5.45M TVL, $32,733.60 daily trading volume (LYNX/USDT at $81,457.61), and 45,415 holders. The LYNX token trades at $0.01533, with a $1.26 million market cap, $4.65 million fully diluted valuation (FDV), 81.89 million circulating supply, 303.52M total supply, and a max supply of =∞. Lynex’s 2,215,135+ transfers and 399.10% volume increase signal growing traction, positioning it as a leader in Linea’s DeFi ecosystem.

Linea vs. Competitors: A Scalability Comparison

| Blockchain | Transactions Per Second (TPS) | Finality |

| Linea | High (ZK-optimized) | <1s |

| Ethereum | 20 | ~12s |

| Solana | 65,000 | ~1s |

Linea’s ZK-powered scalability and low fees make it a DeFi powerhouse, with Lynex leveraging this infrastructure to attract traders and liquidity providers.

Why Lynex Stands Out in DeFi

Lynex redefines DeFi with its concentrated liquidity, ve(3,3) model, and ZK Dark Pools. Here’s why it’s a game-changer:

- Concentrated Liquidity for Capital Efficiency

Powered by Algebra Finance’s 2.0 technology, Lynex’s concentrated liquidity pools allow users to provide liquidity within specific price ranges (e.g., $1,900-$2,100 for ETH/USDC), offering up to 10x capital efficiency compared to traditional DEXs. This reduces slippage, enhances fee generation, and attracts traders to Linea’s ecosystem. - veLYNX: Governance and Rewards

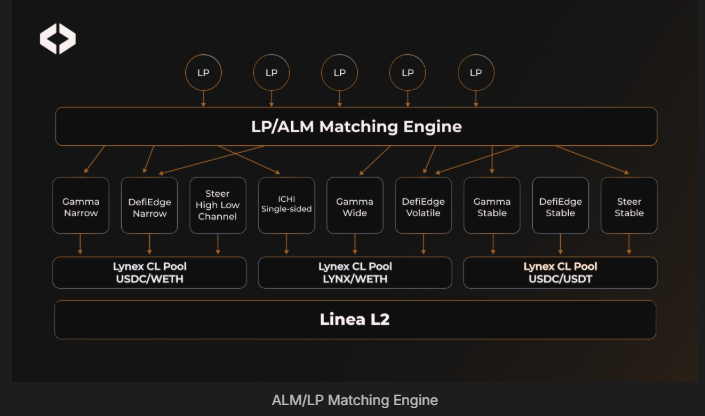

Locking LYNX for veLYNX (veNFTs) grants voting power to direct 5M weekly LYNX emissions (1% decay), earn 100% of trading fees, and claim 100% of bribes (e.g., USDC incentives). Rebases (52% cap, decreasing 1% weekly) protect against dilution, ensuring long-term value for holders. - Automated Liquidity Management (ALM)

Lynex’s ALM marketplace enables a “set-and-forget” strategy, with partners like Gamma, ICHI, Steer, DefiEdge, and Clip Finance optimizing liquidity positions for maximum APRs and minimal impermanent loss. ALMs compete to offer the best yields, simplifying DeFi for all users.

- Dynamic Fee Model

Lynex’s fees adjust to market conditions: 0.25% for volatile pairs, 0.01% for correlated pairs (e.g., USDC/USDT), and 2% for native pairs (e.g., LYNX/WETH). Fees split as 8% to ecosystem incentives, 20% to LPs, and 72% to veLYNX holders, with adjustable ranges (0.2-2% volatile, 0.01-0.03% correlated) for efficiency. - zkLynex: Privacy with ZK Dark Pools

Leveraging ZK-SNARKs, zkLynex enables private, large-scale transactions without market disruption, protecting against MEV and front-running. This positions Lynex as a pioneer in privacy-focused DeFi on Linea. - Thriving Linea Ecosystem Synergy

With Linea’s 100+ protocols and LEIA funding, Lynex addresses the “cold start liquidity” challenge, supporting new and established projects. Its 6.3% volume increase, 45,442 holders, and 2.2M+ transfers highlight its growing role in Linea’s DeFi expansion.

How Lynex Works

Lynex combines token swapping, liquidity provision, and governance into a seamless, non-custodial DEX. Built on a robust codebase derived from Solidly, Thena, and Velodrome, Lynex introduces innovations like dLIMIT, dTWAP, and cross-chain swaps powered by Axelar and Squid Router.

Key Features

- Token Swapping: Efficiently swap tokens via Classic (UniV2-style) or Concentrated Liquidity pools, integrated with aggregators like ODOS, OpenOcean, Kyber, and Orbs for optimal pricing.

- Liquidity Provision: Choose Classic (variable/stable), FUSION (ALM-managed), or Manual Concentrated Liquidity (CL) pools to earn oLYNX emissions and 20% of swap fees.

- veLYNX Voting: Direct emissions via weekly gauge votes (Thursdays, 0 UTC), earning 100% of fees and bribes.

- oLYNX Options: Redeem oLYNX for LYNX at a discount, convert to veLYNX (1:1), or (soon) exchange for LYNX-ETH LP tokens.

- dLIMIT: Decentralized limit orders via Orbs Network for precise price execution.

- dTWAP: Time-weighted average price trading for large orders, minimizing market impact.

- Cross-Chain Swaps: Seamless asset transfers across blockchains via Axelar and Squid Router.

- Security: Audits by Secure3, OpenZeppelin, PeckShield, ABDK, Hexens, and Hacken ensure a robust platform.

How to Get Started with Lynex

Here’s a step-by-step guide to join Lynex:

- Set Up Wallet: Configure MetaMask with Linea’s details:

Network: Linea

RPC: https://rpc.linea.build

Chain ID: 59144

Currency: ETH - Bridge Assets: Transfer USDC or ETH to Linea via the native bridge https://bridge.linea.build or MetaMask bridge https://portfolio.metamask.io/bridge.

- Trade: Visit lynex.fi, swap tokens in LYNX/USDT ($81,457.61 daily volume) or other pools.

- Provide Liquidity: Deposit into Classic, FUSION, or Manual CL pools and stake LP tokens in gauges for oLYNX rewards.

- Lock LYNX: Convert LYNX to veLYNX to vote and earn fees/bribes.

- Track Rewards: Use Linea’s explorer https://lineascan.build for insights.

Join Lynex’s , 29,113 discord members, 872 youtube subscribers , and follow @LynexFi on X (85K followers) for updates.

Lynex’s Tokenomics: Built for Sustainability

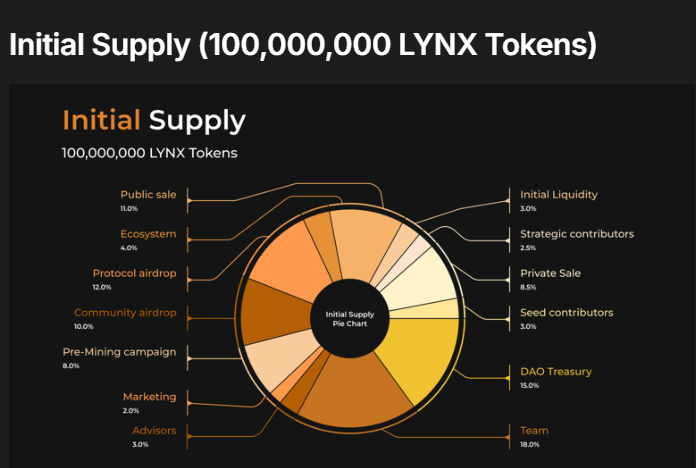

Lynex’s tokenomics, with an initial supply of 100M LYNX, 303.52M total supply, and max supply of ∞, align stakeholders for growth:

- Marketing (2%, 2M): 100% after 2-month cliff.

- Strategic (2.5%, 2.5M): 10% at TGE, 6-month cliff, 6-month linear vesting.

- Initial Liquidity (3%, 3M): 100% at TGE.

- Advisors (3%, 3M): 10% at TGE, 6/12/24-month distributions.

- Seed (3%, 3M): 10% at TGE, 6/12/24-month distributions.

- Ecosystem (4%, 4M): 60% at 1 month, 4-month vesting.

- Pre-Mining (8%, 8M): 50% at Week -2, 50% locked for 24 months.

- Private (8.5%, 8.5M): 10% at TGE, 6/12/24-month distributions.

- Community Airdrop (10%, 10M): 10% unlocked, 30% veLYNX at 6/12/24 months.

- Public (11%, 11M): 20% at TGE, 20% monthly.

- Protocol Airdrop (12%, 12M): Permanently locked in veLYNX.

- DAO Treasury (15%, 15M): 10% at 1 month, 90% locked in veLYNX for 24 months.

- Team (18%, 18M): 10% at 1 month, 90% locked in veLYNX for 24 months.

Emissions: 5M weekly LYNX (1% decay), with 4% to developers, 44%-96% to LPs (increasing over 52 weeks), and 52% rebase cap (decreasing 1% weekly). oLYNX redemptions allocate 30% for LYNX buybacks (bribed as bveLYNX), 30% as USDC incentives, and 40% to the treasury, fostering sustainability.

Token Addresses:

- LYNX: 0x1a51b19CE03dbE0Cb44C1528E34a7EDD7771E9Af

- veLYNX: 0x8D95f56b0Bac46e8ac1d3A3F12FB1E5BC39b4c0c

- oLYNX: 0x63349BA5E1F71252eCD56E8F950D1A518B400b60

- bveLYNX: 0xe8a4c9B6a2b79Fd844c9e3AdBc8Dc841eEce557B

Lynex’s Advantages and Challenges

Advantages

- Concentrated Liquidity: Up to 10x capital efficiency with Algebra Finance’s 2.0 technology.

- ve(3,3) Rewards: 100% of fees and bribes for veLYNX holders, with rebases for dilution protection.

- ALM Marketplace: Gamma, ICHI, Steer, DefiEdge, and Clip Finance optimize yields.

- zkLynex Privacy: ZK-SNARKs enable private, MEV-resistant transactions.

- Linea Synergy: Leverages Linea’s 100+ protocols and LEIA funding for growth.

Challenges

- Lower TVL: $5.36M TVL reflects Lynex’s early stage on Linea.

- Smaller Market Cap: $1.26M market cap and $0.01533 price indicate volatility (96.83% below $0.4846 peak).

- Growing User Base: 45,442 holders and 85K Twitter, 3,021 Discord, 7 187 members Telegram communities are expanding but smaller than larger DEXs.

Risks and Mitigations

Risks

- Smart Contract Vulnerabilities: Potential flaws could lead to losses.

- Impermanent Loss: Volatile pools risk losses outside price ranges.

- Oracle Risks: Mispricing could affect trades.

- Market Volatility: LYNX’s $0.01533 price (21.19% above $0.01267 low) is volatile.

Mitigations

- Audited Codebase: Secure3, OpenZeppelin, PeckShield, ABDK, Hexens, and Hacken audits ensure security.

- ALMs: Optimize ranges to minimize impermanent loss.

- Trusted Oracles: Chainlink and API3 provide accurate pricing.

- Timelock Transparency: OpenZeppelin Defender notifications on Discord and Telegram ensure trust.

Community Vibes: Join the Lynex Movement

Lynex’s community thrives with 85K Twitter followers, 3,021 Discord members, and 7 187 members Telegram members, driving engagement through governance and the Roar & Earn campaign. “Lynex’s ZK Dark Pools and ALMs are live on Linea! Trade LYNX/USDT with $81,457.61 volume. #Linea #Lynex” (July 2025). With 2,215,135+ transfers, 45,415 holders, and a 6.5% volume increase, Lynex is a key player in Linea’s growing DeFi ecosystem.

Roar & Earn Campaign

This DeFiZoo initiative rewards contributions (e.g., tweets, articles, memes) with bveLYNX points. Submit up to 4 weekly posts in the #community-content Discord channel, earning 10-1,000 points based on content type and quality (1.5x-3x multipliers for 1K-20K+ followers). Time-limited quests offer bonus rewards, fostering community-driven growth across Lynex, Ocelex, and Catex.

Join the Lynex Revolution

Lynex empowers users to trade, provide liquidity, and govern in Linea’s thriving DeFi ecosystem. Swap tokens with 0.01% fees, earn oLYNX via gauges, or vote with veLYNX for 100% of fees and bribes. Explore Linea’s explorer https://lineascan.build for analytics. Shape the future of DeFi with Lynex on Linea!