Mendi Finance: Your Easy Path to DeFi Rewards on Linea

Picture a world where you can lend your crypto to earn steady interest, borrow funds for your next big idea, or even help shape a platform—all while keeping full control of your money. That’s Mendi Finance, a decentralized lending and borrowing platform on the Linea blockchain, a lightning-fast, low-cost Layer-2 network built on Ethereum. With a buzzing community of 158 Medium followers and 69,267 Discord members, Mendi is the heart of Linea’s DeFi scene. Whether you’re new to crypto or a DeFi pro, Mendi makes earning yields and accessing liquidity simple, safe, and exciting. Let’s dive into why Mendi Finance is your ticket to Linea’s DeFi revolution!

What is Linea?

Linea is a super-fast, secure, and affordable Layer-2 blockchain launched by Consensys in 2023, designed to turbocharge Ethereum’s capabilities. Using zero-knowledge (ZK) proofs, Linea processes transactions in a flash with tiny fees while keeping your funds as safe as Ethereum itself. It’s home to over 100 protocols, including Mendi Finance, Lynex, and ZeroLend, and works seamlessly with tools like MetaMask. Linea’s mission is to be the “home network” for DeFi, NFTs, and gaming, offering fast transaction finality, low costs, and a vibrant-community for users and developers.

Mendi Finance: Linea’s Lending Powerhouse

Mendi Finance is a decentralized, non-custodial platform that lets you lend and borrow crypto without middlemen. Launched in August 2023, it’s grown to a $16,599,077 Total Value Locked (TVL) and a $8,868.81daily trading volume (July 2025), with 29,826 holders and 706,269 total transfers. Its native token, MENDI, trades at $0.01789, with a $568,120 market cap and a $1,788,738 fully diluted valuation. With a circulating supply 31,760,929 and a max supply of 100 million, Mendi is a cornerstone of Linea’s DeFi ecosystem, offering easy ways to earn, borrow, and grow your crypto.

Why Mendi Finance Shines

Mendi stands out with features that make DeFi accessible, rewarding, and secure. Here’s what makes it special:

- Lend and Borrow Made Simple

Lend popular assets like ETH, WBTC, USDC, USDT, DAI, wstETH, ezETH, weETH, or wrsETH to earn interest through meTokens, which grow in value as borrowers pay fees. Need funds? Borrow up to a percentage of your deposit (e.g., 85% for USDC, 65% for WBTC) using meTokens as collateral. Mendi’s algorithmic interest rates adjust based on demand—more borrowing means better yields for lenders. Linea’s low fees and fast transactions make it a breeze. - Dual Rewards and Staking Power

Stake MENDI to get sMENDI or uMENDI, earning 80-100% of protocol revenue (from lending fees) and oLYNX rewards from liquidity bribes on Lynex. Riskier pools like WBTC (20% reserve factor) generate higher fees, shared weekly with stakers. A 7-day unstaking delay ensures fairness. Stakers also join the Mendi DAO, voting on platform upgrades, reward rates, and new features, giving you a real say in Mendi’s future. - Mendi Loyalty Points (MLP): Fun Rewards for All

Mendi’s MLP system lets you earn points by lending, borrowing, or doing community tasks, potentially unlocking Linea airdrops. In 2-week epochs, aim for on-chain (e.g., hitting borrowing targets) and social (e.g., sharing posts on X) milestones. Meet both, and you get MLP plus sMENDI airdrops (up to 100,000 MENDI per epoch). With 670,000 MLPs allocated, early joiners score bigger rewards. Verify social tasks on Intract and join the 69,267-strong Discord community to stay in the loop. - MLP-L: Supercharge Your Linea Surge

During the Linea Surge, Mendi’s MLP-L rewards asset suppliers with 200,000 points per Volt (monthly), boosting your share of potential airdrops. Points are based on your supply’s time-weighted value, with early adopters getting multipliers. This encourages more lending, keeping Mendi’s pools full and vibrant. MLP-L complements MLP, ensuring both lenders and borrowers thrive. - Top-Notch Security

Built on Compound V2’s battle-tested codebase, Mendi adds extra safety with a ScaleBit audit and HyperNative real-time monitoring. Price feeds from trusted oracles like Chainlink, API3, and eOracle ensure accurate data, reducing risks. A MetaMask Snap alerts you if your borrow limit is at risk, letting you adjust positions. Mendi’s permissionless liquidation clears bad debt, keeping the system stable. - Fair Launch, Community-Driven

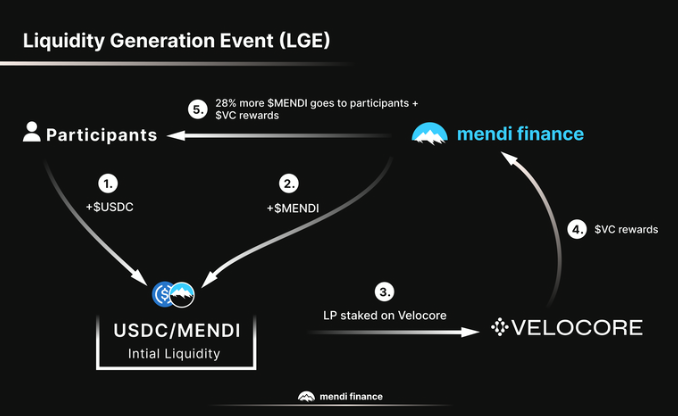

Mendi’s fair launch gave 60% of MENDI tokens to the community through rewards, bribes, and a Liquidity Generation Event (LGE), where 3.5 million MENDI were distributed with a 28% bonus. The LGE paired USDC with 2.5 million MENDI for a MENDI/USDC pool on Velocore, locked for 180 days. The Mendi DAO, backed by 158 Medium followers and 69,267 Discord members, drives decisions, with the core team holding just 12% (vested over 2 years) for transparency.

How Mendi Works: Lending and Borrowing Explained

Mendi’s mechanics are easy to understand:

- Lending: Deposit assets into liquidity pools to mint meTokens (e.g., meUSDC or meETH). These earn interest as borrowers pay fees, and you can use them as collateral. For example, depositing 1000 USDC (with an 85% collateral factor) lets you borrow up to $850 in another asset.

- Borrowing: Borrow against your collateral up to its limit (e.g., 80% for wETH, 70% for ezETH). Interest rates adjust dynamically based on pool usage, ensuring fair yields. If collateral values drop, liquidators may step in, but Mendi’s MetaMask Snap alerts help you stay safe.

- Reserves: A small reserve factor (e.g., 10% for USDT, 20% for wstETH) from borrower interest funds liquidations and staker rewards, keeping Mendi sustainable.

Bridging to Linea: Get Started in Minutes

To join Mendi, bring your assets to Linea:

- Native Token Bridge: Securely move assets like USDC from Ethereum to Linea using Linea’s official bridge. It’s trusted by big names like Uniswap, though slightly slower for maximum safety.

- Third-Party Bridges: For faster transfers from other Layer-2s, use Across Protocol . It’s secure, quick, and low-slippage, leveraging native bridges with relayers.

Set up a wallet like MetaMask

Mendi’s Tokenomics: Built for Fairness

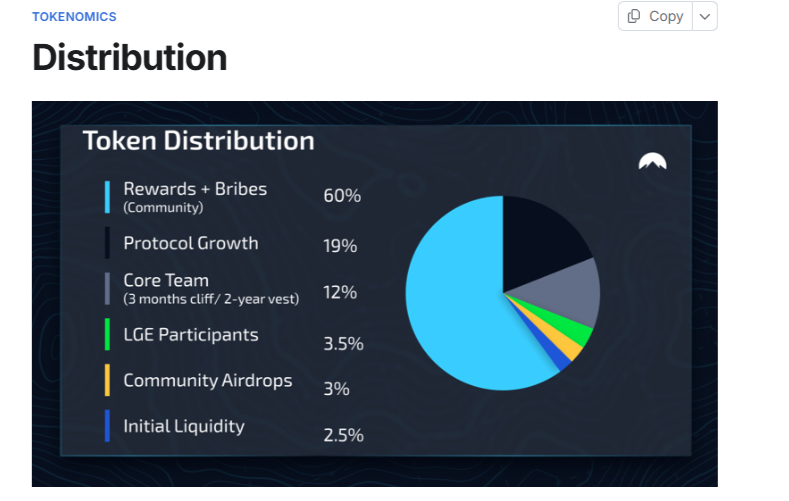

Mendi’s 100 million MENDI max supply is designed to prioritize the community:

- 60% (60M MENDI): Rewards, bribes, and staking incentives for lenders and borrowers.

- 19% (19M MENDI): Protocol growth (e.g., 915,798 for staking refunds, 17.8M remaining).

- 12% (12M MENDI): Core team, vested over 2 years with a 3-month cliff, staked with a 7-day unlock delay for transparency.

- 3.5% (3.5M MENDI): LGE participants, with 28% bonus tokens (half vested over a year).

- 3% (3M MENDI): Community airdrops (e.g., 313,847 for Galxe, 1.6M remaining).

- 2.5% (2.5M MENDI): Initial liquidity for MENDI/USDC on Velocore.

Emissions started August 17, 2023, and run for 3 years, decreasing monthly (e.g., 155,391 MENDI/day in month 1, 118,116/day in month 5). After the first month, rewards split 10% supply, 70% borrow, and 20% bribes, adjustable by the Mendi DAO, ensuring long-term value and community focus.

Maximize Your Mendi Experience: Tips and Tools

Want to get the most out of Mendi Finance? Whether you’re lending to earn steady yields, borrowing for flexibility, or staking for rewards, Mendi offers a range of tools and strategies to supercharge your DeFi journey. With Linea’s low-cost transactions and Mendi’s community-driven design, you’re set to thrive in DeFi.

- Start Small to Build Confidence: If you’re new to DeFi, begin with a small deposit, like 100 USDC, to test lending or borrowing. Mendi’s user-friendly interface and transparent risk tools make it easy to see how your assets grow or how to manage collateral. Check your positions regularly to stay on top of market changes.

- Use MetaMask Snap for Safety: Mendi’s MetaMask Snap monitors your borrow limit and sends pop-up alerts if you’re at risk of liquidation due to price drops. Customize your alert threshold and frequency, and use multiple RPC endpoints (e.g., Infura, Alchemy) for reliable updates. This helps protect your funds, especially in volatile markets.

- Boost Rewards with MLP-L in Linea Surge: Supply assets like wETH, USDC, or DAI to earn MLP-L points during the Linea Surge. With 200,000 MLP-L distributed per Volt (monthly), your time-weighted supply determines your share of potential airdrops. Early adopters get multipliers, so supplying now maximizes rewards. No need to withdraw and redeposit—your current supply counts automatically.

- Engage with the Mendi Community: Join Mendi’s 69,267-member Discord and 158-follower Medium community to stay updated on Summit Sync calls (e.g., Nov 5, 2025, for MLP updates). Suggest milestones for MLP epochs, like social tasks (sharing X posts, joining Discord spaces) or on-chain goals (borrowing targets). Vote on Snapshot to shape the next epoch’s rewards, making participation fun and rewarding.

- Stack Rewards with Third-Party Points: Amplify your earnings with programs like Renzo Points (3x for ezETH supply), ether.fi Loyalty Points (2x for weETH), and KelpDAO’s Kelp Miles (3x for wrsETH). These stack with Mendi’s MLP and MLP-L, making your lending even more lucrative.

- Manage Market Volatility: MENDI’s price ($0.01749) is 97.51% below its $0.7033 peak but 197.09% above its $0.005885 low. Sudden price drops can affect collateral, so diversify across stable assets like USDC (85% collateral factor) or USDT (85%) and use Mendi’s risk tools to monitor positions. This keeps your funds secure.

- Shape Mendi with DAO Voting: Stake MENDI for sMENDI or uMENDI to earn 80-100% of protocol revenue and vote on DAO proposals. Adjust emission splits (currently 10% supply, 70% borrow, 20% bribes), propose new assets, or tweak reward rates. Your votes help Mendi evolve and grow.

- Leverage Linea’s Ecosystem Tools: Track your lending, borrowing, and staking on Linea’s explorer https://lineascan.build or other on-chain analytics platforms for real-time insights. Linea’s MetaMask Debit Card lets you spend your crypto earnings in real life, adding flexibility to your Mendi rewards. Stay active to earn Linea Surge rewards and boost your DeFi portfolio.

These tips help you navigate Mendi with ease, whether you’re chasing yields, airdrops, or governance power. With Linea’s low-cost transactions and Mendi’s community-driven design, you’re set to thrive in DeFi.

Community Vibes: Join the Mendi Movement

Mendi’s community is alive and thriving, with 158 Medium followers sharing insights and a 69,267-member Discord driving engagement. The Mendi DAO empowers stakers to vote on milestones, emission rates, and new features during Summit Sync calls (e.g., Nov 5, 2025, for MLP updates). X posts spark excitement: “Mendi’s MLP-L is live for Linea Surge! Supply assets to earn points and airdrops. #Linea #MendiFinance” (July 2025). Users love the fair rewards and community focus, though the $8,868.81 daily volume suggests room to grow and attract more traders.

Opportunities and Challenges

- Why Get Excited?

- Low-cost, fast lending on Linea’s ZK-powered network.

- Real-yield staking shares 80-100% of protocol revenue.

- MLP and MLP-L make earning airdrops fun and fair.

- Secure design with audited code, HyperNative monitoring, and trusted oracles.

- Community-driven with 60% of tokens allocated to users.

- Things to Watch:

- MENDI’s $0.01789 price is 97.46% below its $0.7033 peak, reflecting market volatility.

- Low trading volume ($8,868.81 ) needs a boost to compete with platforms like Lynex.

- Smart contract risks and market volatility require careful monitoring, though Mendi’s alerts help.

- As a newer protocol, Mendi is still building its long-term track record compared to giants like AAVE.

How to Dive into Mendi Finance

Ready to jump in? Here’s how to get started:

- Set Up a Wallet: Use MetaMask with Linea’s network details (RPC: https://rpc.linea.build, Chain ID: 59144, Currency: ETH).

- Bridge Assets: Move funds to Linea using the native bridge or Across Protocol https://across.to for faster transfers.

- Lend or Borrow: Visit mendi.finance, deposit assets to earn interest, or borrow against collateral.

- Stake MENDI: Lock MENDI for sMENDI/uMENDI to earn revenue and vote in the DAO.

- Chase Points: Earn MLP/MLP-L by lending, borrowing, or completing tasks. Track your progress on Linea’s explorer https://lineascan.build.

Join the Discord for the latest updates and community events.

Mendi’s Bright Future on Linea

Mendi Finance is poised to lead Linea’s DeFi wave with plans for institutional DeFi integration, expanded asset support, and advanced staking rewards. Linea’s ecosystem, with 100+ protocols, the MetaMask Debit Card for real-world crypto spending, and LEIA funding for developers, fuels Mendi’s growth. Upcoming features will simplify trading strategies and boost yields, making DeFi even more accessible. While Mendi’s $16,599,077 TVL is impressive, increasing its $8,868.81 daily volume will help it outshine competitors like Lynex. and MLPs MENDI airdrops, and a passionate community of 69,267 Discord members and 158 Medium followers, Mendi is set to shine in 2025 and beyond.

Join the Mendi Revolution

Mendi Finance is more than a lending platform—it’s a community-driven hub where you can grow your crypto, earn rewards, and shape the future of DeFi on Linea. Whether you’re lending USDC, staking MENDI, or chasing MLP rewards, Mendi makes DeFi fun, secure, and accessible. Visit mendi.finance, follow @MendiFinance on X, and join the 158 Medium and 69,267 Discord community. Share your thoughts below, and let’s build Linea’s DeFi future together!