Nile: Revolutionizing DeFi Trading with Concentrated Liquidity on Linea

In the fast-evolving world of decentralized finance (DeFi), Nile is emerging as a trailblazer, redefining trading on the Linea blockchain. Launched as a sister fork of RAMSES on Arbitrum, Nile is a next-generation decentralized exchange (DEX) that brings hyper-efficient concentrated liquidity to Linea, empowering users to trade, provide liquidity, and govern with unmatched efficiency. With a $5.77M Total Value Locked (TVL), 49,965 holders, over 2.6M transfers, and a vibrant community of 13.1K Twitter followers, 1,694 Discord members, and 485 Telegram members, Nile is driving Linea’s DeFi revolution. As Linea’s thriving ecosystem gains momentum, Nile is poised to capture attention and lead the charge in DeFi trading. This guide explores how Nile works, its standout features, and why it’s a cornerstone of Linea’s growing DeFi landscape.

What is Linea?

The Linea blockchain, launched by Consensys in 2023, is a high-performance Layer-2 network built on Ethereum, designed for speed, affordability, and security. Powered by zero-knowledge (ZK) proofs, Linea processes transactions with sub-second finality and low fees while maintaining Ethereum-level security. With over 100 protocols, seamless MetaMask integration, and developer support through the LEIA funding program, Linea’s ecosystem is thriving, boasting a vibrant community for DeFi, NFTs, and gaming. As the proto-danksharding EIP (Ethereum Improvement Proposal) boosts Layer-2 scalability, Linea is becoming the go-to “home network” for traders, liquidity providers, and innovators, making it the perfect stage for Nile’s growth.

Nile: Linea’s Concentrated Liquidity Powerhouse

Nile is a decentralized, non-custodial DEX that optimizes trading and liquidity provision with its ve(3,3) model, inspired by Andre Cronje’s Solidly. With a $5.77m TVL, $425,062 daily trading volume (down -29.80%in 24 hours), 49,965 holders, and over 2,631,400 total transfers, Nile ranks #2020 on CoinGecko. Its native token, NILE, trades at $1.49, with a $6.69 million market cap and a $22.52 million fully diluted valuation (FDV). With a circulating supply of 4.50 million, total supply of 15.16M, and a max supply = ∞, Nile is designed for efficiency and growth, positioning it as a key player in Linea’s burgeoning DeFi ecosystem.

Linea vs. Competitors: A Scalability Comparison

| Blockchain | Transactions Per Second (TPS) | Finality |

| Linea | High (ZK-optimized) | <1s |

| Ethereum | 20 | ~12s |

| Solana | 65,000 | ~1s |

Linea’s ZK-powered scalability, low fees, and support for high-frequency trading make it a DeFi powerhouse, with Nile at the forefront of its growing ecosystem.

Why Nile Stands Out in DeFi

Nile differentiates itself in Linea’s competitive DeFi landscape through its innovative concentrated liquidity and ve(3,3) model, offering efficiency, rewards, and inclusivity. Here’s why it’s a game-changer:

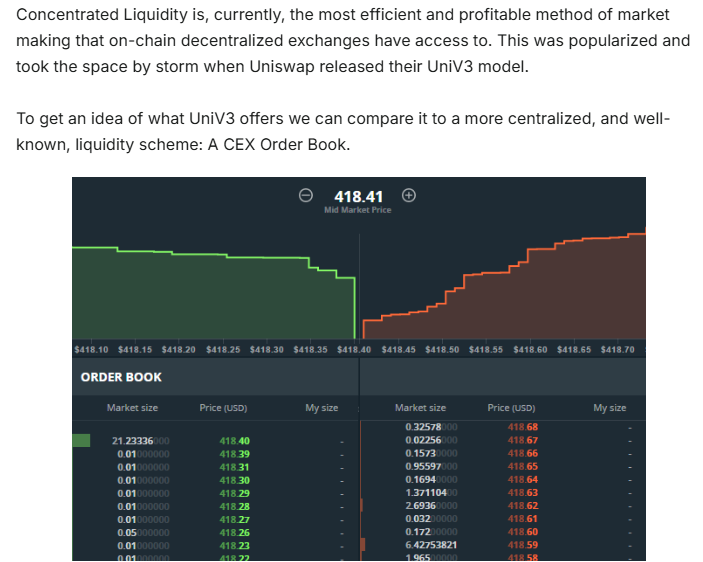

- Concentrated Liquidity for Maximum Efficiency

Nile’s concentrated liquidity lets users provide liquidity within specific price ranges (e.g., $1,000-$1,100 for WETH), making capital up to 100x more efficient than traditional DEXs. This reduces slippage and boosts trading efficiency, attracting traders and liquidity providers to Linea’s ecosystem.

- veNILE: Governance and High Yields

Lock NILE tokens for veNILE (veNFTs) to vote on liquidity pools, earn 72% of swap fees, and claim 100% of vote bribes (e.g., 1,000 USDC for sole voters). Dilution protection rebases (25% per epoch, rising to 50%) ensure your stake grows despite new emissions. For example, if you hold 1,000 NILE (10% of 10,000 supply) and 10,000 new tokens are emitted, you’d get 250 extra NILE. - Competitive Farming with CL Gauges

Nile’s CL Gauges reward liquidity providers (LPs) based on position size, tick range, and utilization (in-range positions). Tighter ranges earn higher rewards, encouraging efficient liquidity that lowers slippage and drives volume. LPs earn 20% of swap fees, NILE emissions, and bribes, offering high APRs. - Flexible Fee Structure

Nile’s fees are competitive: 0.25% for volatile pairs, 0.01% for correlated pairs (e.g., USDC/USDT), and 2% for native pairs (e.g., NILE/WETH). Adjustable fees (0.2-2% for volatile, 0.01-0.03% for correlated) ensure affordability, with 8% to ecosystem incentives, 20% to LPs, and 72% to veNILE holders. - Unmatched Security

Nile’s codebase, audited by PeckShield, Code4rena, and yAudit (for CL contracts under a BUSL-1.1 license), fixes Solidly vulnerabilities. A timelock mechanism delays upgrades, shared via OpenZeppelin Defender on Nile’s 1,695-member Discord and 481-member Telegram, ensuring transparency and safety. - Thriving Linea Ecosystem Synergy

As Linea’s ecosystem grows with 100+ protocols and LEIA funding, Nile is positioned to capture attention, drawing traders and LPs with its low fees and high yields. Its 32.6% volume increase, 49,965 holders, and 2.6M+ transfers signal strong momentum, making Nile a cornerstone of Linea’s DeFi expansion.

How Nile Works

Nile’s non-custodial DEX uses concentrated liquidity and the ve(3,3) model to create efficient trading markets. Users can swap tokens, provide liquidity, or vote with veNILE, all powered by Linea’s fast, low-cost infrastructure.

Key Features

- Concentrated Liquidity Pools: Support volatile (x*y=k) or correlated (x³y + y³x ≥ k) pairs, with fee tiers (0.01%, 0.05%, 0.3%, 1%) for optimal trading.

- CL Gauges: Reward LPs for in-range positions, boosting APRs and reducing slippage.

- veNILE Voting: Direct 1,250 NILE emissions per epoch to pools, earning real-time swap fees and bribes at epoch flips (Thursdays, 0 UTC).

- xNILE Sustainability: Earn xNILE in low-impact pools (80% xNILE/20% NILE), vesting for 14-120 days or converting to veNILE (0.7:1). Exit penalties fund high-volume pool bribes.

- Trusted Oracles: Chainlink and API3 ensure accurate pricing for fair trades.

- Non-Custodial Design: Users retain control of funds, with secure staking via CL Gauges.

How to Get Started with Nile

Here’s a step-by-step guide to join Nile:

- Set Up Wallet: Configure MetaMask with Linea’s details:

Network: Linea

RPC: https://rpc.linea.build

Chain ID: 59144

Currency: ETH - Bridge Assets: Transfer USDC or ETH to Linea via the native bridge https://bridge.linea.build or MetaMask bridge https://portfolio.metamask.io/bridge.

- Trade: Visit nile.exchange, swap tokens in NILE V1 (e.g., NILE/WETH, $312,512 daily volume).

- Provide Liquidity: Deposit into a pool (e.g., USDC/USDT, 0.01% fee) and stake LP tokens in CL Gauges.

- Stake NILE: Lock NILE for veNILE to vote and earn fees/rebases.

- Track Rewards: Use Linea’s explorer https://lineascan.build for real-time insights.

Join Nile’s 1,695-member Discord and 481-member Telegram for updates.

Nile’s Tokenomics: Built for Growth

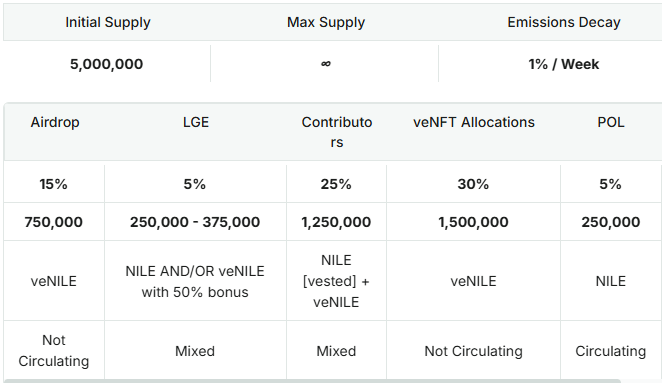

Nile’s tokenomics, with an initial supply of 5M NILE and a max supply = ∞, prioritize decentralization and rewards:

- 15% (750,000 NILE): Airdrop, not circulating.

- 5% (250,000-375,000 NILE): Liquidity Generation Event (LGE), mixed circulation.

- 25% (1.25M NILE): Contributors, vested and mixed.

- 30% (1.5M NILE): veNILE allocations, not circulating.

- 5% (250,000 NILE): Protocol-Owned Liquidity (POL), circulating.

- 20% (1M NILE): Reserves, not circulating.

Emissions decay by 1% weekly, with 100% going to gauges (no team allocations). Emissions follow Emissions(t) = E0 * e^(-rt), adjustable for market demand. Rebases (25%, rising to 50%) protect veNILE holders from dilution, supporting the 49,965 holders driving 2,614,569+ transfers.

Nile’s Advantages and Challenges

Advantages

- Concentrated Liquidity: Up to 100x capital efficiency for traders and LPs.

- ve(3,3) Rewards: Shares 72% of swap fees and 100% of bribes with veNILE holders.

- Linea Integration: Leverages Linea’s low fees and high TPS to attract users.

- Affordable Token: NILE’s $1.49price is accessible to retail investors.

- Growing Ecosystem: Linea’s 100+ protocols and LEIA funding boost Nile’s visibility and adoption.

Challenges

- Lower TVL: Nile’s $5.77m TVL reflects its early stage in Linea’s ecosystem.

- Smaller Market Cap: Nile’s $6.69 million market cap and $1.49price indicate volatility.

- Growing User Base: Nile’s 49,965 holders show strong adoption, but its 13.1K Twitter, 1,695 Discord, and 481 Telegram communities are still expanding.

Risks and Mitigations

Risks

- Smart Contract Vulnerabilities: Undiscovered flaws could lead to losses.

- Impermanent Loss: Volatile pools risk losses if prices shift outside ranges.

- Oracle Risks: Mispricing could affect trades or liquidations.

- Market Volatility: NILE’s price $1.49, 39.35% below $2.45 peak) is volatile.

Mitigations

- Audited Codebase: PeckShield, Code4rena, and yAudit ensure security.

- CL Gauges: Reward in-range positions to minimize impermanent loss.

- Trusted Oracles: Chainlink and API3 provide accurate pricing.

- Timelock Transparency: OpenZeppelin Defender notifications on Discord and Telegram ensure trust.

Community Vibes: Join the Nile Movement

Nile’s community is buzzing, with 13.1K Twitter followers hyping up the platform, 1,695 Discord members engaging in governance and timelock updates, and 481 Telegram members sharing insights. X posts spark excitement: “Nile’s concentrated liquidity is live on Linea! Trade NILE/WETH with $208,886 daily volume and earn big. #Linea #NileDEX” (July 2025). The 2,614,569+ transfers and 49,965 holders show strong adoption, while the -29.80% decrease signals growing traction, positioning Nile to thrive in Linea’s expanding ecosystem.

Joinisms the Nile Revolution

Nile empowers users to trade, provide liquidity, and govern with unmatched efficiency in Linea’s thriving DeFi ecosystem. Swap tokens with 0.01% fees, earn high APRs via CL Gauges, or vote with veNILE for rewards. Visit nile.exchange to start, join the 1,695-member Discord and 481-member Telegram (t.me/NileOfficial), and follow @NileExchange on X (13.1K followers). Explore Linea’s explorer https://lineascan.build for analytics. Shape the future of DeFi with Nile on Linea!