Silo Finance: Revolutionizing DeFi Lending on Sonic Blockchain in 2025

In the rapidly evolving world of decentralized finance (DeFi), Silo Finance is emerging as a trailblazer, redefining lending on the Sonic blockchain. Launched in 2018, Silo Finance offers a non-custodial lending protocol that empowers users to borrow and lend any cryptocurrency with unmatched security and efficiency. With $318.79m in Total Value Locked (TVL) and a $17.14M market cap as of July 2025, Silo is driving Sonic’s DeFi revolution through its innovative isolated lending markets and permissionless borrowing model. This comprehensive guide explores how Silo Finance works, its standout features, and why it’s a cornerstone of Sonic’s thriving ecosystem.

What is Silo Finance?

Silo Finance is a decentralized lending protocol built on the Sonic blockchain, a high-performance Layer-1 network launched in August 2024 as the successor to Fantom. Unlike traditional lending platforms like AAVE, Silo introduces isolated lending markets—or “silos”—that support two assets: a bridge token (typically S) and a unique token (e.g., USDC, stS). This design ensures that risks, such as token exploits or price volatility, are confined to individual silos, protecting users’ funds across the protocol.

With a $162.32M TVL, $997,314 with the daily trading volume (up 1.80%in 24 hours), and a $0.04071 token price, Silo Finance ranks #137o on CoinGecko, boasting a $33.09M fully diluted valuation (FDV) and 421M circulating SILO tokens (out of a 1B max supply). Its permissionless design allows any ERC-20 token on Sonic to form a lending market, mirroring the inclusivity of Uniswap’s liquidity pools and making DeFi accessible to all.

The Sonic Blockchain: A DeFi Powerhouse

The Sonic blockchain, launched in August 2024, is an Ethereum-compatible Layer-1 network designed for speed and efficiency. With an impressive 400,000 transactions per second (TPS)—far surpassing Ethereum’s 20 TPS and Solana’s 65,000 TPS—Sonic offers sub-second finality and low-cost transactions. Its proof-of-stake consensus ensures a low carbon footprint, as detailed at soniclabs.com/environment.

Sonic’s ecosystem, thrives with protocols like Silo Finance, DeFive, Shadow Exchange, SwapX, and Beets Finance. The Sonic Gateway enables 10-minute asset bridging (e.g., USDC from Ethereum) with a 14-day fail-safe for security. Developers benefit from the Fee Monetization (FeeM) program, sharing 90% of app fees, and the 200M S Innovator Fund, driving innovation. Partnerships with Chainlink, Solv Protocol, AAVE, and Formula One’s Pierre Gasly solidify Sonic’s position as a DeFi leader.

Sonic vs. Competitors: A TPS Comparison

| Blockchain | TPS | Finality |

| Sonic | 400,000 | <1s |

| Ethereum | 20 | ~12s |

| Solana | 65,000 | ~1s |

Why Silo Finance Stands Out in DeFi

Silo Finance differentiates itself in Sonic’s competitive DeFi landscape through its innovative features, offering security, efficiency, and inclusivity. Here’s why it’s a game-changer:

1.Risk-Isolated Lending Markets for Enhanced Security

Silo’s isolated silos ensure that risks like token exploits or price manipulation are confined to specific markets. For example, a vulnerability in the stS-S [3] silo won’t affect the S-USDC [20] silo, unlike AAVE’s shared-risk pools, where all assets are exposed. This secure-by-design approach protects lenders and borrowers, making Silo ideal for risk-averse users in volatile markets.

2. Permissionless Borrowing for Universal Access

Silo’s permissionless design allows any ERC-20 token on Sonic to create a lending market, enabling users to deposit niche assets like wOS, EGGS, or USDC and borrow others. This inclusivity, akin to Uniswap’s liquidity pools, contrasts with AAVE’s curated asset list, empowering retail investors, developers, and institutions to engage with diverse tokens.

3. Concentrated Liquidity for High Capital Efficiency

Using a bridge token (S), Silo connects all silos, concentrating liquidity to reduce slippage and boost APRs (e.g., 12%–15% in high-yield silos like wstkscUSD-USDC [23]). This single-pool design ensures deeper markets compared to AAVE’s multi-asset pools, offering higher returns for lenders and better borrowing rates.

4. Dynamic Interest Rates for Market Balance

Silo’s Dynamic Kink Interest Rate Model (IRM) adjusts rates based on market utilization. For example, if 90% of USDC in the S-USDC [20] silo is borrowed, rates rise to attract repayments, ensuring liquidity. At low utilization, rates drop to encourage borrowing, providing competitive yields (e.g., 12% APR) and predictable costs.

5. Community Governance via xSILO

By staking SILO tokens for xSILO, users join the SiloDAO, controlling 410M SILO (41% of supply) in the Community Treasury. xSILO holders vote on parameters like new silos, interest rates, and rewards, shaping Silo’s future. For instance, a recent vote increased S-USDC [20] APR to 15%, boosting yields. Additionally, 50% of protocol revenue funds SILO buybacks, enhancing the xSILO:SILO Index Ratio for stakers.

How Silo Finance Works

Silo’s non-custodial protocol uses isolated silos to create programmable lending markets. Each silo supports two assets (e.g., S and stS), with overcollateralized lending ensuring borrower collateral exceeds loan value. Users can act as suppliers, borrowers, or vault managers, with external apps leveraging Silo for liquidity.

Key Features

Isolated Pairs: Each silo (e.g., stS-S [3], S-USDC [20]) supports two-sided lending, isolating risks to specific markets for precise risk management.

Dynamic Interest Rates: The IRM adjusts rates based on utilization (e.g., 14% APR at 85% utilization in wOS-S [22]), ensuring liquidity and competitive yields.

Flexible Borrowing Parameters: Each silo has a maximum Loan-to-Value (mLTV) (e.g., 95% for stS) and Liquidation Threshold (LT) (e.g., 97%), protecting lenders while enabling safe borrowing.

Trusted Oracles: Silo uses Chainlink and Redstone for real-time price feeds, ensuring accurate pricing and fair liquidations.

Liquidation Mechanism: If a borrower’s Health Factor reaches 0, liquidators seize collateral (e.g., 25% of stS) to repay loans, maintaining solvency.

Hooks System: Developers can add custom logic for actions like deposits or borrowing, enabling integrations with yield optimizers and DEXs.

How to Get Started with Silo Finance

Here’s a step-by-step guide to join Silo Finance:

Set Up Wallet: Configure MetaMask or Rabby with Sonic’s details:

Network: Sonic

RPC: rpc.soniclabs.com

Chain ID: 146

Currency: S

Bridge Assets: Use the Sonic Gateway to transfer USDC or S from Ethereum in 10 minutes.

Deposit: Visit app.silo.finance, select a silo (e.g., S-USDC [20]), and deposit tokens to earn interest.

Borrow: Use deposited tokens as collateral to borrow up to the mLTV, monitoring your Health Factor to avoid liquidation.

Stake SILO: Stake for xSILO to earn rewards and vote in SiloDAO.

Track Rewards: Use the upcoming Silo Points dashboard and sonicscan.org for insights.

xSILO: Governance and Rewards

Staking SILO for xSILO (an ERC-4626 contract) unlocks governance and rewards:

Staking Rewards: xSILO holders earn 50% of protocol revenue via SILO buybacks, increasing the xSILO:SILO Index Ratio (e.g., 1 xSILO = 2 SILO after 6 months).

Governance Power: Vote on new silos, interest rates, and rewards via SiloDAO, controlling 410M SILO.

Flexible Redemption: Redeem xSILO for SILO with a Redemption Factor (0.5 immediate, 1 at 6 months).

Cross-Chain Compatibility: xSILO is bridgeable to Ethereum, Arbitrum, and Avalanche via Chainlink Transporter.

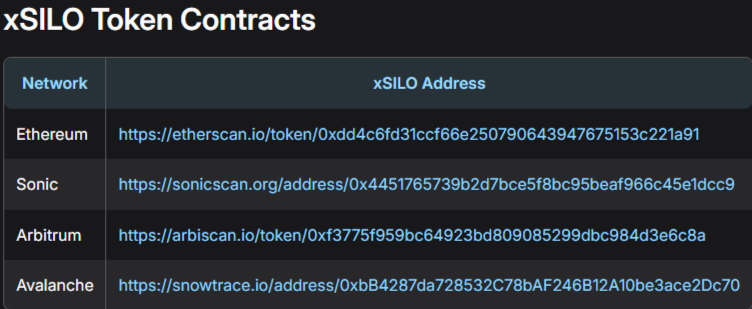

xSILO Addresses

| Network | Address |

| Sonic | 0x4451765739b2d7bce5f8bc95beaf966c45e1dcc9 |

| Ethereum | 0xdd4c6fd31ccf66e250790643947675153c221a91 |

| Arbitrum | 0xf3775f959bc64923bd809085299dbc984d3e6c8a |

| Avalanche | 0xbB4287da728532C78bAF246B12A10be3ace2Dc70 |

Silo Finance vs. AAVE V3: A Comparison

While AAVE V3 dominates with a $31.493B TVL and $4.977B market cap, Silo Finance, in its growth phase since launching on Sonic in 2024, offers unique advantages:

| Protocol | TVL | Daily Volume | Market Cap | Token Price | Total Supply | Unique Features | |

| AAVE V3 | $31.493B | $1,178,306,880 | $4.977B | $335.46 | 16M AAVE | Multi-asset lending, flash loans | |

| Silo Finance | $318.79m | $997,314 | $17.35 m | $0.04116 | 1B SILO | Isolated silos, permissionless markets, xSILO |

Silo’s Challenges

Lower TVL: Silo’s $318.79m TVL trails AAVE’s $31.493B, reflecting AAVE’s multi-chain dominance.

Smaller Market Cap: Silo’s $17.35M market cap and $0.04116 price indicate volatility as a new entrant.

Smaller User Base: Silo’s 10,000 users lag behind AAVE’s 50,000+, but its community is growing via Telegram (t.me/SiloIntern) and Discord.

Silo’s Advantages

Risk Isolation: Silo’s silos confine risks, unlike AAVE’s shared-risk pools.

Permissionless Markets: Any token can form a silo, unlike AAVE’s curated assets.

High Efficiency: Concentrated liquidity via bridge tokens boosts APRs.

Affordable Token: SILO’s $0.04116 price attracts retail investors.

Sonic Integration: 2x–3x Sonic Points and 90% Sonic Gems enhance rewards.

Risks and Mitigations

Risks

Smart Contract Vulnerabilities: Undiscovered flaws could lead to losses.

Collateral Risks: Permissionless tokens may include risky assets.

Oracle Risks: Mispricing or downtime could trigger unfair liquidations.

Liquidation Risks: Price drops may liquidate borrowers’ collateral.

Bad Debt: Unliquidated positions could prevent withdrawals.

Mitigations

Isolated Design: Limits systemic risks to individual silos.

Trusted Oracles: Chainlink and Redstone ensure accurate pricing.

SiloDAO Governance: Community votes balance risk and reward.

Audits and Bug Bounties: Rigorous testing minimizes contract risks.

Future Outlook for Silo Finance

Silo’s 2025–2026 roadmap positions it to lead Sonic’s lending landscape:

Q3 2025: Launch Silo Points dashboard and expand SiloDAO voting.

Q4 2025: Integrate cross-chain silos via Chainlink.

Q1 2026: Add BTC-based silos with Solv Protocol.

Q2 2026: Support AI-driven DeFi apps from the DeFAI Hackathon.

With a 1.80% daily volume increase and Sonic’s 190.5M S airdrop, Silo’s $162.32M TVL and 10,000 users are poised to grow, potentially rivaling AAVE’s Sonic presence by 2026.

Join the Silo Finance Revolution

Silo Finance empowers users to lend, borrow, and govern with unmatched security and efficiency. Deposit into silos for 12%+ APRs, borrow with 95% mLTV, or stake SILO for xSILO rewards. Visit app.silo.finance to start, join t.me/SiloIntern for community insights, and explore sonicscan.org for analytics. Shape the future of DeFi with Silo on Sonic!