ZeroLend: Powering DeFi Lending Innovation on Linea’s zkEVM Ecosystem

ZeroLend is a trailblazing, multi-chain, non-custodial lending protocol on the Linea blockchain, redefining decentralized finance (DeFi) with its focus on Layer-2 (L2) solutions, Liquid Restaking Tokens (LRTs), Real World Assets (RWAs), Bitcoin-based DeFi (BTCFi), and memecoins. Launched on May 6, 2024, with its native $ZERO token priced at $0.00004476, ZeroLend boasts a $3.40M market cap, $4.47M fully diluted valuation (FDV), $59.51M Total Value Locked (TVL), and $872,838 daily trading volume (down -17.00% in the last 24 hours as of July 25, 2025). With 104,596 holders, 2,644,042+ transfers, and a thriving community of 309.5K Twitter followers, 217,526 Discord members, and 2,044 Telegram members, ZeroLend is a cornerstone of Linea’s vibrant ecosystem. Secured by audits from Chaos Labs, Zokyo, Halborn, PeckShield, Sherlock, ImmuneFi, Cantina, Hypernative, and Hexagate, ZeroLend offers permissionless lending and borrowing with innovative features like the ZeroLend Credit Card and Zero Gravity airdrop. This comprehensive guide explores ZeroLend’s features, tokenomics, and its pivotal role in Linea’s DeFi revolution.

What is Linea?

Linea, launched by Consensys in July 2023, is a high-performance Ethereum Layer-2 network leveraging zero-knowledge Ethereum Virtual Machine (zkEVM) technology. It delivers sub-second transaction finality, fees up to 15x lower than Ethereum Layer-1, and Ethereum-level security through ZK proofs. Linea fosters a thriving ecosystem for DeFi, NFTs, gaming, and social applications. Its LEIA funding program and proto-danksharding EIP enhance scalability, saving users over $380M in gas fees since launch. ZeroLend leverages Linea’s robust infrastructure to provide efficient, user-centric lending solutions, aligning with the upcoming $LINEA token generation event (TGE) in Q1 2025.

ZeroLend: A Multi-Chain DeFi Lending Leader

ZeroLend is a decentralized, non-custodial lending protocol forked from Aave V3, inheriting its battle-tested smart contract codebase while introducing cutting-edge features tailored for Linea and other chains (Ethereum, Blast, Manta, zkSync, X Layer). With a $59.51M TVL, 99.85B total supply, 75.03B circulating supply, and 100B max supply, ZeroLend ranks #2572 on CoinGecko. Its $872,838daily trading volume (down -17.00%) and 2,644,042+ transfers reflect strong market activity. The $ZERO token (contract: 0x78354f8dccb269a615a7e0a24f9b0718fdc3c7a7) powers governance, staking, and incentives, bridgeable via LayerZero for cross-chain functionality. ZeroLend’s ecosystem supports LRT lending, RWA lending, and the innovative ZeroLend Credit Card, positioning it as a leader in Linea’s DeFi landscape.

Why ZeroLend Stands Out in DeFi

ZeroLend distinguishes itself in Linea’s ecosystem with a suite of innovative features, robust security, and a community-centric approach:

- Multi-Chain Architecture for Seamless Interoperability: ZeroLend operates across Linea, Ethereum, Blast, Manta, zkSync, and X Layer, with $ZERO bridgeable via LayerZero, enabling users to lend, borrow, and stake across multiple ecosystems with minimal friction.

- Liquid Restaking Token (LRT) Lending for Enhanced Yields: Supports LRTs like $ezETH (Renzo), $pufETH (Puffer), $weETH (Ether.fi), and $rsETH (Kelp DAO), allowing users to deposit staked assets, borrow stablecoins/ETH, and earn staking rewards plus ecosystem points (e.g., EigenLayer points).

- Real World Asset (RWA) Lending for Financial Inclusion: Enables tokenized RWAs (e.g., $USDC, $USDT, $USDe) for over-collateralized loans, addressing DeFi’s over-collateralization challenge. The RWA market is projected to grow from $1.5T in 2024 to $16T by 2030, per Boston Consulting Group.

- ZeroLend Credit Card for Real-World Usability: Allows users to deposit crypto as collateral, borrow USDC, and spend at Visa/Mastercard merchants globally without selling assets, offering flexible repayment and no fixed due dates.

- Robust Security Through Extensive Audits and Bug Bounties: Audited by Chaos Labs, Zokyo, Halborn, PeckShield, Sherlock, ImmuneFi, Cantina, Hypernative, and Hexagate, with $300K bug bounties on Cantina and ImmuneFi. A native Insurance Fund protects users from unforeseen losses.

- Community-Driven Growth and Engagement: With 309.5K Twitter followers, 217,526 Discord members, 2,044Telegram members, and 104,596 holders, ZeroLend fosters a vibrant community, amplified by the Zero Gravity airdrop and integration with Linea’s LXP-L program.

- High Efficiency Mode (E-Mode) for Capital Optimization: Boosts borrowing capacity with up to 97% LTV for correlated assets (e.g., stablecoins like $USDC, $ONEZ), enhancing capital efficiency while maintaining risk controls.

How ZeroLend Works

ZeroLend delivers a permissionless, decentralized lending protocol with advanced features for lending, borrowing, and leveraging assets, built on a modular, secure infrastructure.

Core Products and Features

- DeFi Lending (Live): Users supply assets (e.g., ETH, stablecoins) to earn supply APY, ecosystem points, and partner rewards (e.g., Merkle, Pendle PT). Borrowers deposit collateral to access loans in stablecoins or ETH instantly, without lengthy approvals, unlike traditional finance (TradFi). Example: Deposit $ETH, borrow $USDT to buy other ETH-based tokens, amplifying exposure while managing leverage risks.

- Liquid Restaking Token (LRT) Lending (Live): Supports LRTs like $ezETH (Renzo), $pufETH (Puffer), $weETH (Ether.fi), and $rsETH (Kelp DAO) on Ethereum, Linea, and Blast. Users deposit LRTs to borrow stablecoins/ETH, earning staking rewards, EigenLayer points, and Zero Gravity points. Example: Stake $ETH on Renzo to mint $ezETH, supply on ZeroLend, and borrow $USDC for yield farming.

- Real World Asset (RWA) Lending (Live): Supports RWA stablecoins (e.g., $USDC, $USDT, $USDe, $eUSD, $USDO++) for lending/borrowing, backed by tokenized assets like bonds or cash equivalents. Offers higher LTV ratios due to stable backing, reducing over-collateralization barriers (e.g., $4M collateral for a $7M loan). Benefits: Financial inclusion for developing economies (e.g., Kenya, Nigeria), streamlined processes, and favorable repayment terms.

- ZeroLend Credit Card: Users deposit crypto (e.g., ETH, FOXY) as collateral, borrow USDC, and spend at Visa/Mastercard merchants globally. Flexible repayment with no fixed due dates; collateral can generate yield to offset interest. Ideal for: Long-term investors and memecoin holders to access liquidity without selling assets.

- Governance with $ZERO: $ZERO holders stake for $veZERO or zLP to vote on protocol parameters (e.g., LTV, emissions). StakeDAO sdZERO enables liquid governance, allowing trading without sacrificing rewards.

Technical Infrastructure

- Smart Contract Architecture: Modular design with separate contracts for lending, borrowing, and liquidation functions. Upgradeable components for future-proofing, with emergency pause functionality. Gas-optimized transactions for cost efficiency on Linea’s zkEVM. Forked from Aave V3, inheriting its audited codebase.

- Oracle Integration: Uses Pyth Network, Redstone, Chainlink, API3, and eOracle for real-time price feeds. Pyth provides institutional-grade data for accurate LTV and liquidation triggers. Redstone supports $STONE, $wUSDM, and BTC LRTs (e.g., LBTC/BTC on Base). Chainlink covers ETH, USDC, BTC, and LRTs on Base, Linea, and Ethereum. eOracle’s ePrice ensures secure pricing for emerging assets.

- Key Parameters: Max LTV: Up to 80% (e.g., $WETH: borrow 0.8 $WETH per $WETH collateral). Example: $10,000 ETH at 75% LTV = $7,500 borrowing capacity. Utilization Rate: Targets 80% to balance interest rates; high utilization (>80%) increases APY to encourage repayments. Health Factor: Above 1 ensures safe positions; below 1 triggers liquidation (e.g., $10,000 ETH, $7,000 USDC borrowed, 82% threshold = 1.17 Health Factor). Liquidation Threshold: 5-15% above LTV (e.g., ETH: 82% threshold, 75% LTV, 7% buffer). Liquidation Penalty: 5-15% fee incentivizes liquidators (e.g., $1,000 debt + 10% penalty = $1,100 collateral sold).

Liquidation Mechanics

- Process: Triggered when Health Factor < 1; liquidators call liquidationCall() to repay debt and receive discounted collateral (2.5% bonus). Example: $18,000 ETH collateral, $10,000 USDC debt, 0.8 Health Factor → $10,500 collateral sold (5% penalty).

- Developer Guide: Liquidators use bots to monitor Health Factor via getUserAccountData(), calculate profitability, and execute via flash loans.

High Efficiency Mode (E-Mode)

- Boosts LTV to 97% for correlated assets (e.g., $USDC, $ONEZ), increasing borrowing capacity. Enable via Dashboard: “Enable E-Mode” for stablecoin pairs; disable to revert to standard LTV.

Isolation Mode for Risk Management

- Restricts volatile assets to stablecoin borrowing with a debt ceiling. Enter by supplying isolated assets; exit by disabling collateralization via Dashboard.

Supply/Borrow Caps

- Limits over-leverage (e.g., 500-unit borrow cap halts at 450 units). Default cap: 0 (no limit), adjusted based on liquidity and risk.

How to Get Started with ZeroLend

Join ZeroLend’s ecosystem with these detailed steps:

- Set Up a MetaMask Wallet for Linea Integration: Configure MetaMask with Linea’s network details: Network: Linea, RPC URL: https://rpc.linea.build, Chain ID: 59144, Currency Symbol: ETH, Block Explorer: https://lineascan.build. Add $ZERO token (contract: 0x78354f8dccb269a615a7e0a24f9b0718fdc3c7a7) to track balances.

- Bridge Assets to Linea for Seamless Transactions: Transfer ETH, stablecoins, or LRTs to Linea via https://bridge.linea.build or https://portfolio.metamask.io/bridge. Ensure sufficient ETH for gas fees (Linea’s low fees minimize costs).

- Acquire $ZERO Tokens on Leading Exchanges: Trade $ZERO on centralized exchanges: Gate: ZERO/USDT pair with $91,699.16 daily volume. BitMart: High liquidity for spot trading. Bybit: Supports active trading with competitive fees.

- Supply Assets to Earn Yields and Rewards: Visit https://app.zerolend.xyz and select a market (e.g., Ethereum LRTs, RWA Stablecoins, Bitcoin LRTs). Supply assets like $ezETH, $pufETH, $weETH, $rsETH, $USDC, or cbBTC to earn supply APY, Zero Gravity points, and partner rewards (e.g., EigenLayer, Renzo). Example: Supply $ezETH on Ethereum LRTs Market to earn boosted yields.

- Borrow Assets for Leverage and Flexibility: Deposit collateral (e.g., ETH, LRTs, RWAs), select a borrowable asset (e.g., $USDC, $ETH), and borrow up to the max LTV (e.g., 80% for $WETH). Monitor Health Factor via Dashboard to avoid liquidation.

- Stake $ZERO or zLP for Governance and Rewards: Stake $ZERO or zLP (ZERO/ETH LP) on https://app.zerolend.xyz/stake. Single Stake $ZERO: Lock for 1-48 months to earn $veZERO (e.g., 10,000 $ZERO for 6 months = 1,250 $veZERO). zLP Staking: Provide ZERO/ETH liquidity on Nile https://www.nile.build/manage/v1/0x0040f36784dda0821e74ba67f86e084d70d67a3a, stake for doubled $ZERO weighting (e.g., 10,000 zLP for 6 months = 5,000 $veZERO). StakeDAO sdZERO: Mint liquid sdZERO for governance and trading flexibility. Earn LXP-L for Linea’s airdrop and 50% ETH/50% Gravity Points revenue.

- Use the ZeroLend Credit Card for Real-World Spending: Deposit crypto collateral (e.g., ETH, FOXY), borrow USDC, and spend at Visa/Mastercard merchants. Repay flexibly without fixed due dates; collateral may generate yield to offset interest.

- Track and Engage with the Community: Monitor positions on https://app.zerolend.xyz and transactions on https://lineascan.build. Join 309.5K Twitter followers (@zerolendxyz), 217,525 Discord members, and 2,044Telegram members (t.me/zerolend) for updates and support.

ZeroLend’s Tokenomics: Designed for Sustainability

$ZERO, launched May 6, 2024, is a Linea ERC-20 token bridgeable via LayerZero, powering governance, staking, and incentives.

- Token Metrics: Max Supply: 100B, Total Supply:99.85B, Circulating Supply: 75.91B, Market Cap: $3.40M, FDV: $4.47M, Holders: 104,596, Transfers: 2,644,042+, Daily Volume: $872,838 (down 17%).

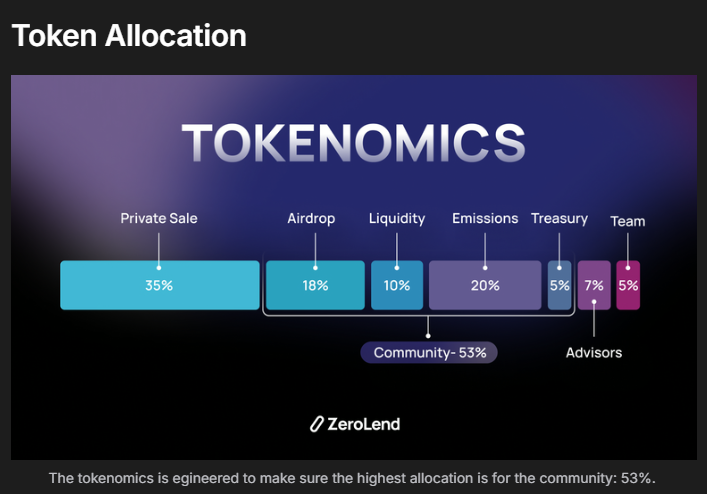

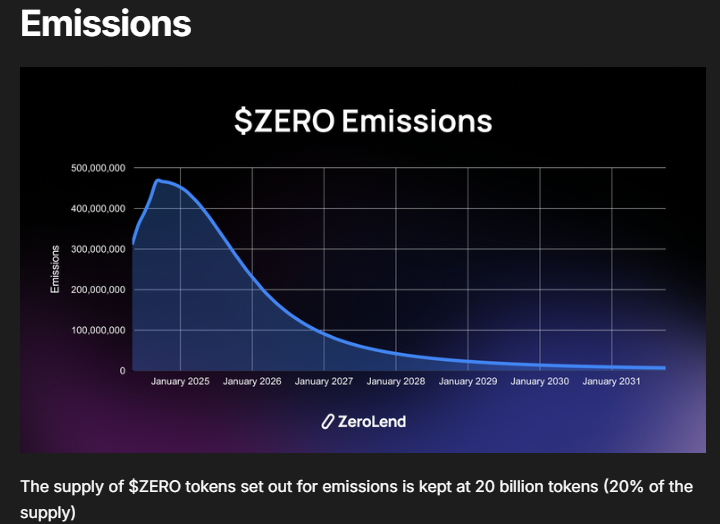

- Token Allocation: Community (53%): Highest allocation to ensure user-driven growth. Emissions (20%): 20B tokens with a 4:1 borrow/lend ratio; inflationary for 6 months, deflationary thereafter. Private Sale: Funds initial development and partnerships. Liquidity: Supports DEX pools (e.g., Nile) on launch. Treasury: Reserved for protocol/DAO sustainability. Advisors: Supports expert guidance for governance. Team: Allocated for core contributors.

- Emission Strategy: 78% circulating after 12 months from TGE; remaining 22% released via exponential decay. Secondary Emissions: Distributed based on $veZERO delegation (e.g., $USDC: 30% = 300K $ZERO; $MANTA: 50% = 500K $ZERO). 4:1 Ratio: Encourages borrowing to drive lending, boosting APYs and protocol revenue.

- Ve-Tokenomics Model: Single Stake $ZERO: Lock for 1-48 months (e.g., 1-month = 0.0208 $veZERO per $ZERO; 48-months = 1.0 $veZERO). zLP Staking: ZERO/ETH LP on Nile doubles $ZERO weighting (e.g., 5,000 $ZERO + 5,000 $ETH for 6 months = 5,000 $veZERO). StakeDAO sdZERO: Mint liquid sdZERO for governance, fee sharing, and trading on secondary markets. Protocol Power: Combines zLP and $ZERO power with time-locking multipliers (e.g., zLP 6-month lock = 0.5 L_dLP; $ZERO 48-month lock = 24 L_z).

- Buyback and Burn: Executed March 7, 2025, burning 0.1% of supply. Reduces circulating supply to enhance $ZERO value over time.

- Zero Gravity Airdrop: Launched: Beta on January 19, 2024; full release on April 10, 2024. Structure: Voyage 1: Zero to Zillion (10B $ZERO): Chapter 1: Ignition (5B tokens, ended May 6, 2024) to bootstrap TVL. Chapter 2: LiftOff (2B tokens, live) for market penetration. Chapter 3: Boost (500M tokens, TBA) for protocol dominance. Eligibility: Supply/borrow to earn points; prior chapter participants receive boosts.

ZeroLend’s Advantages and Challenges

Advantages

- Multi-Chain Scalability: Supports Linea, Ethereum, Blast, Manta, zkSync, and X Layer for broad accessibility.

- Innovative Lending Markets: LRT and RWA lending unlock new yield opportunities, with $60.51M TVL reflecting adoption.

- ZeroLend Credit Card: Bridges DeFi and real-world spending, enabling global purchases without selling crypto.

- Robust Security Framework: Audited by Mundus, PeckShield, Halborn, Zokyo; $300K bug bounties; Insurance Fund for user protection.

Community-Driven Ecosystem: 309.5K Twitter, 217,525 Discord, 2,044Telegram, 104,596 holders drive engagement.

- High Efficiency Mode: Up to 97% LTV for stablecoin pairs, optimizing capital efficiency.

Challenges

- Market Volatility: $ZERO at $0.00004476 (96.38% below $0.001229 peak) faces price fluctuations.

- Liquidation Risks: Volatile collateral requires proactive Health Factor monitoring.

- Competitive Landscape: Competes with Aave V3 and other established protocols.

Risks and Mitigations

Risks

- Price Volatility: $ZERO (41.76% above $0.00003136 low) is susceptible to market swings.

- Smart Contract Vulnerabilities: Potential risks despite extensive audits.

- Liquidation Exposure: Health Factor < 1 triggers collateral sales, impacting borrowers.

Mitigations

- Comprehensive Audits: Mundus found no codebase inconsistencies; PeckShield resolved 8 medium/low issues; Halborn fixed a staking flaw; Zokyo reported zero critical vulnerabilities.

- Insurance Fund: Allocates fees to cover losses from vulnerabilities or system failures.

- Risk Management Tools: E-Mode, Isolation Mode, supply/borrow caps, and Health Factor alerts minimize liquidation risks.

- Timelocked Multisig: Requires 3/5 signatures and a 5-day delay for administrative actions, enhancing security.

Community Vibes: Join the ZeroLend Movement

ZeroLend’s community is a driving force, with 309.5K Twitter followers (@zerolendxyz), 217,525 Discord members, 2,044 Telegram members (t.me/zerolend), and 104,582 holders. X posts highlight enthusiasm: “Earn LXP-L and $veZERO by staking on ZeroLend! Join Linea’s DeFi revolution.With 2,644,042+ transfers, $59.51M TVL, and integrations with Nile and StakeDAO, ZeroLend fuels Linea’s ecosystem. The Zero Gravity airdrop incentivizes participation, aligning with Linea’s 420+ partners and 250M+ transactions.

Join the ZeroLend Revolution

ZeroLend empowers users to lend, borrow, stake, and spend crypto seamlessly on Linea’s zkEVM. Supply LRTs or RWAs, stake $ZERO for governance, or use the ZeroLend Credit Card for real-world purchases. Shape the future of DeFi with ZeroLend!